Capital One Login: Capital One, a leading financial institution, offers diverse banking solutions tailored to modern needs.

Accessing your Capital One account online is crucial for managing finances efficiently, ensuring you can oversee transactions, monitor balances, and receive timely updates, all with enhanced security and convenience.

This accessibility supports effective financial management anytime, anywhere.

Preparing to Log In to Your Capital One Account

Logging into your Capital One account should be straightforward and secure. Ensuring you meet all requirements and securing your device are critical steps to protect your financial information. Here’s how you can prepare efficiently:

Requirements for Logging In

- Official Capital One App or Website: Always use the official Capital One website (www.capitalone.com) or the Capital One mobile app downloaded from a trusted source such as Google Play Store or Apple App Store.

- Account Credentials: You will need your username and password. If you are logging in for the first time or have reset your credentials, you might also need to answer security questions or enter a verification code sent to your email or phone.

- Compatible Device: Ensure that your device, whether a smartphone, tablet, or computer, is compatible with the latest version of the Capital One app or browser requirements.

- Internet Connection: A stable and secure internet connection is required to access your account without interruptions.

Ensuring Your Device is Secure Before Logging In

- Update Your Device: Make sure your operating system and any related software are up-to-date to protect against vulnerabilities.

- Install Security Software: Use reputable antivirus and anti-malware software. Regularly scan your device to detect and remove threats.

- Enable Firewall: A firewall can help protect your device from unauthorized access. Ensure it is enabled and properly configured.

- Use Secure Networks: Avoid logging into your account from public or unsecured Wi-Fi networks. Use a secured network, ideally one that is encrypted with a strong password.

- Two-Factor Authentication: Enable two-factor authentication (2FA) on your account for an added layer of security. This requires a second form of identification beyond just your password.

By meeting these login requirements and ensuring your device is secure, you can safeguard your Capital One account and enjoy a seamless online banking experience.

Step-by-Step Guide to Capital One Login

Below, we provide simple instructions tailored for both web and app users, ensuring you can manage your finances effortlessly.

For Web Users:

1. Visit the Official Website: Open your preferred web browser and go to Capitalone.com.

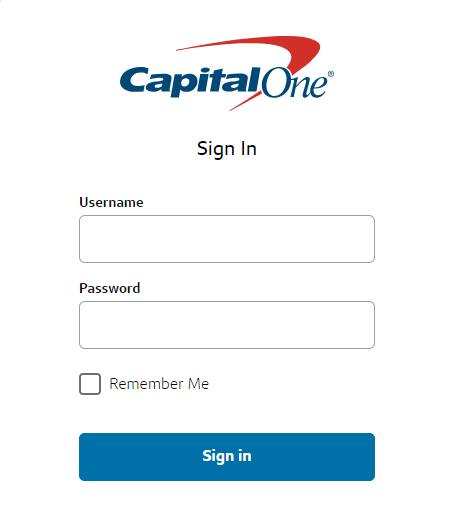

2. Access the Login Page: Click on the ‘Sign In’ button typically located at the top right corner of the homepage.

3. Enter Your Credentials: Type in your username and password in the respective fields. If you’re logging in from a public or shared device, remember to uncheck any ‘Remember Me’ options for security purposes.

4. Secure Login: Double-check your details and click ‘Sign In’ to access your account.

5. Troubleshoot: If you encounter any issues logging in, utilize the ‘Forgot Username or Password?’ link to reset your credentials.

For App Users:

1. Download the App: Install the Capital One mobile app from the App Store or Google Play Store.

2. Open the App: Tap on the app icon on your device to open it.

3. Sign In: Enter your username and password. For enhanced security and ease, consider setting up biometric login options available on your device, such as fingerprint or facial recognition.

4. Confirm Your Details: Review your entered information and tap ‘Sign In’ to proceed to your account.

5. Account Recovery: If you forget your login details, use the ‘Forgot Username or Password?’ option within the app to regain access.

Importance of Reviewing Terms Before Agreeing

Understanding the terms and conditions of any financial service is crucial before you agree to them. Here’s why it’s important:

1. Legal Awareness: Terms and conditions outline your legal rights and obligations. Knowing these can prevent potential legal issues.

2. Hidden Fees: Sometimes, accounts might have fees or penalties that aren’t immediately apparent. Reviewing the terms helps you understand all possible charges.

3. Privacy Policies: It’s essential to know how your personal and financial information will be used and protected. Terms and conditions provide details about the bank’s data handling practices.

4. Account Limitations: Certain accounts have limitations and usage restrictions that you should be aware of to avoid unintended service interruptions or penalties.

However, always take the time to read through and understand the terms and conditions thoroughly before accepting them to ensure they align with your financial needs and expectations.

Common Capital One Login Problems and How to Troubleshoot Them

Encountering login issues with your Capital One account can be frustrating, but there are straightforward solutions to most problems. Below, we explore common login issues and provide tips on how to resolve them effectively.

What to Do if You Forget Your Username or Password

- Reset Your Password: Click on the “Forgot password” link on the login page. You will need to provide your username and verify your identity to receive a password reset link.

- Retrieve Your Username: If you forget your username, select the “Forgot username” link. You’ll need to provide your email address or social security number linked to your account to receive your username.

Handling Locked Accounts or Unauthorized Access Alerts

- Account Lockout: If your account is locked due to multiple incorrect login attempts, wait for a set period (usually 15-30 minutes) before trying again. Alternatively, you can reset your password to regain access immediately.

- Unauthorized Access: If you receive alerts for unauthorized access, change your password immediately and review your account transactions. Contact Capital One customer support if you notice any discrepancies.

Tips for Resolving Common Error Messages Seen During the Login Process

- Check Browser Compatibility: Ensure that your web browser is up-to-date as outdated browsers may not support the latest security protocols required by Capital One.

- Clear Cookies and Cache: Sometimes, clearing your browser’s cookies and cache can resolve login issues. This refreshes your browser settings and removes old data that may be causing problems.

- Enable JavaScript and Cookies: Make sure JavaScript and cookies are enabled in your browser settings as these are essential for the functioning of most banking platforms, including Capital One.

- Use the Correct URL: Always make sure you are logging in from the official Capital One website to avoid phishing attempts. Check the URL carefully each time you log in.

By following these steps, you can solve most login issues with your Capital One account and ensure a smoother, more secure online banking experience.

Managing Your Capital One Account Online

Managing your Capital One account online streamlines your banking experience by offering comprehensive tools and features that are easy to use. Here’s how you can make the most of your online account management:

Features Available Post-Login

Once you log in to your Capital One account, you gain access to a variety of features designed to enhance your banking experience:

- Account Overview: Quickly view your balance, recent transactions, and account statements.

- Bill Pay: Easily set up and manage your monthly bill payments.

- Fund Transfer: Transfer money between your Capital One accounts or to external bank accounts.

- Investment Services: Access and manage your investment portfolios directly from your dashboard.

- Loan Management: View loan details, make payments, and manage your loan account.

Updating Personal Information and Changing Security Settings

Keeping your personal information and security settings up-to-date is crucial for safeguarding your account. Here’s how you can update them:

- Personal Information: Navigate to the settings menu, select ‘Personal Information’, and update your address, phone number, or email as needed.

- Security Settings: Under the same menu, go to ‘Security Settings’ to change your password, update security questions, or enable two-factor authentication for an added layer of security.

Setting Up Account Alerts and Notifications

Stay informed about important account activities by setting up alerts and notifications:

- Balance Alerts: Receive notifications when your balance falls below a specified amount.

- Transaction Alerts: Set up alerts for specific transaction activities, such as large withdrawals or deposits.

- Security Alerts: Enable notifications for security-related events, like login attempts or changes to your account settings.

By taking advantage of these online tools, you can efficiently manage your Capital One account, ensuring you stay informed and in control of your finances.

Enhancing Your Online Security with Capital One

Online banking offers convenience but also requires vigilance to protect your personal information. By following best practices and leveraging Capital One’s robust security features, you can enhance your online security.

Best Practices for Maintaining Online Banking Security

- Use Strong, Unique Passwords: Create complex passwords using a combination of letters, numbers, and symbols. Avoid using easily guessed information such as birthdays or simple sequences.

- Enable Two-Factor Authentication: Add an extra layer of protection by requiring a second form of verification, such as a text message code.

- Beware of Phishing Scams: Always be cautious of unsolicited emails or messages asking for your banking information. Verify the source before clicking on any links.

- Regularly Monitor Account Activity: Frequently check your bank statements for any suspicious transactions and report them immediately.

Capital One’s Security Features

- Fraud Alerts: Receive real-time alerts for suspicious activity on your account.

- Encryption Technology: Capital One uses advanced encryption to protect your data during transmission.

- Account Monitoring: Automated systems continuously monitor for unusual activity to safeguard your accounts.

- Card Lock: Instantly lock your credit card from the mobile app if it’s lost or stolen.

Advice on Regular Password Updates and Secure Log-Out Practices

- Update Passwords Regularly: Change your banking passwords every few months to minimize the risk of unauthorized access.

- Avoid Reusing Passwords: Use different passwords for your online banking and other accounts to reduce the chances of a security breach.

- Always Log Out After Each Session: Ensure you log out completely from your online banking sessions, especially on shared or public devices.

- Clear Browser History: Clear your browsing history and cookies after banking sessions to protect your data.

By incorporating these best practices and making the most of Capital One’s security features, you can enjoy the convenience of online banking with peace of mind.

FAQs about Capital One Login

1. How do I log in to my Capital One account?

To log in to your Capital One account, visit the official Capital One website or use the mobile app. Enter your username and password, then click “Sign In.”

2. What should I do if I forget my Capital One login credentials?

If you forget your username or password, click the “Forgot Username or Password?” link on the login page. Follow the prompts to reset your credentials.

3. Why am I having trouble logging into my Capital One account?

Login issues can arise from entering incorrect credentials, a locked account, or browser compatibility problems. Ensure your details are correct, and try clearing your browser’s cache or updating your app.

4. How can I enhance the security of my Capital One login?

Enhance security by enabling two-factor authentication (2FA) and regularly updating your password. Always log out after your session and avoid using public Wi-Fi for banking transactions.

5. Can I log into multiple Capital One accounts?

Yes, you can log into multiple Capital One accounts by switching between them after logging out from one account.

6. What should I do if I suspect unauthorized access to my Capital One account?

If you suspect unauthorized access, immediately change your password and contact Capital One customer service to secure your account.

Conclusion

In conclusion, secure and efficient access to your Capital One account is essential for managing your finances with confidence. By leveraging the online features provided, you can take full control of your financial activities, ensuring that your money works for you at all times.

Whether it’s tracking your spending, setting up alerts, or making payments, Capital One’s online tools make it easier than ever to stay on top of your financial goals.

Start utilizing these features today to optimize your financial management and secure your financial future.

References

For further reading and to validate the information provided in this guide on Capital One login, we’ve compiled a list of reputable sources. These references offer in-depth insights and up-to-date details on secure banking practices, troubleshooting login issues, and optimizing your online banking experience.

- Capital One Official Login Guide: Explore the official Capital One website for a comprehensive guide on how to securely access your account.

- Federal Trade Commission on Online Security: Learn more about best practices for online security, including safeguarding your banking credentials.

- Norton Cybersecurity Tips: A resourceful article by Norton offering advice on how to protect your online accounts from potential threats.

These sources are selected to ensure you have access to reliable and accurate information while managing your Capital One account.