TurboTax Login: TurboTax offers streamlined tax preparation services, simplifying complex tax filings.

Efficient access to your TurboTax account is crucial for managing your finances and ensuring timely and accurate tax submissions.

Understanding how to navigate this platform can significantly ease the tax filing process.

What is TurboTax?

TurboTax is a widely recognized software package designed for preparing and filing taxes in the United States. Developed by Intuit, TurboTax simplifies the complex process of tax filing for both individuals and businesses by transforming IRS regulations and forms into a user-friendly, question-and-answer format.

Role of TurboTax in Tax Preparation

TurboTax serves several vital roles in tax preparation:

- Accuracy Assurance: The software includes error-checking features that ensure your tax calculations are accurate and compliant with the latest tax laws.

- Automated Calculations: It automatically calculates your tax obligations based on the financial information you provide, reducing the risk of human error.

- E-file Integration: TurboTax facilitates direct e-filing with the IRS, enabling faster processing of returns and refunds.

- Tailored Guidance: The platform offers guidance that is personalized to your unique tax situation, which helps in maximizing deductions and credits.

Benefits of Using TurboTax for Managing Taxes

Using TurboTax to manage your taxes offers several benefits:

- Time Efficiency: TurboTax significantly reduces the time it takes to complete a tax return by automating complex calculations and providing a streamlined interface.

- User-Friendly Interface: Its intuitive design makes it accessible for users with little to no tax knowledge, guiding them through each step of the filing process.

- Up-to-Date Information: TurboTax updates its software annually to reflect the latest federal and state tax laws, ensuring compliance and the most advantageous tax treatment.

- Secure Data Handling: The platform employs robust security measures to protect sensitive personal and financial information.

- Access to Expert Help: TurboTax provides options for live assistance from certified tax professionals, enhancing support for complex tax situations.

By leveraging TurboTax, taxpayers can navigate the intricacies of tax preparation with greater confidence and ease, ensuring compliance and maximizing potential refunds or minimizing liabilities.

Preparing to TurboTax Login

Logging into your TurboTax account is straightforward, but proper preparation ensures a seamless and secure access experience. Here’s how to efficiently manage your TurboTax login process:

Necessary Credentials for Logging into Your TurboTax Account

- User ID: Your unique identifier; ensure you remember or securely store your user ID.

- Password: Keep your password complex to prevent unauthorized access.

- Email Address: Linked to your account for recovery and notifications.

- Security Questions and Answers: Needed for additional account security and identity verification during login or password recovery.

Tips on How to Manage and Secure Your Login Details

- Use a Password Manager: Store your TurboTax credentials in a password manager. This not only secures them with strong encryption but also makes it easy to retrieve them without having to remember each detail.

- Regular Updates: Change your password periodically to fend off potential security threats. Aim for complex passwords that combine letters, numbers, and symbols.

- Enable Two-Factor Authentication (2FA): Enhance the security of your TurboTax account by enabling 2FA. This adds an extra layer of protection by requiring a second form of identification beyond just your password.

- Beware of Phishing Attacks: Be vigilant about phishing attempts. Always verify the authenticity of emails or messages claiming to be from TurboTax and never click on suspicious links or share your credentials.

- Secure Your Devices: Ensure that any device you use to log into TurboTax has adequate security measures, such as updated antivirus software and a firewall.

By adhering to these practices, you can protect your TurboTax account from unauthorized access and maintain control over your sensitive financial information.

Step-by-Step Guide to TurboTax Login

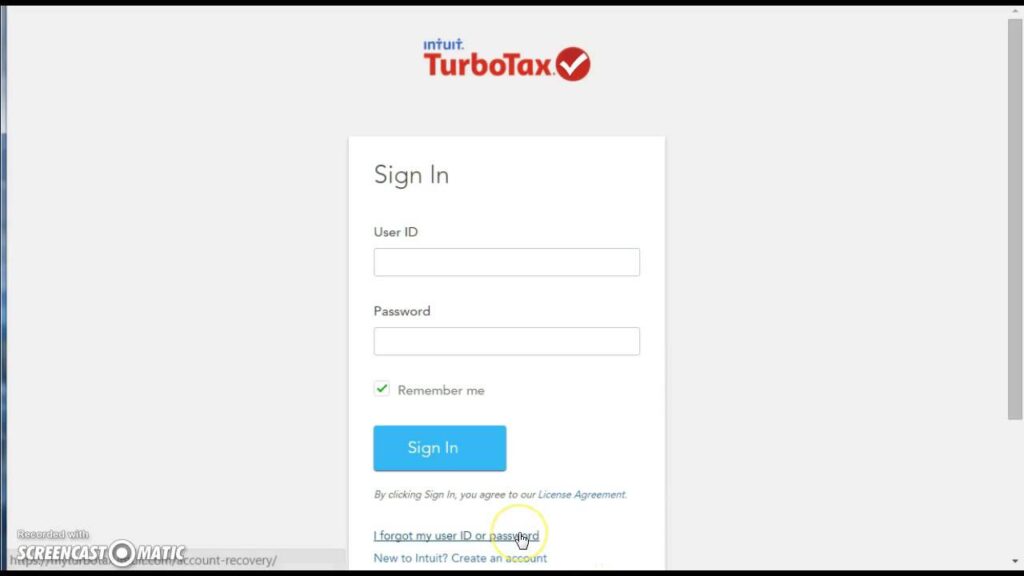

Logging into TurboTax is straightforward whether you’re using the web or the mobile app. Follow these simple steps to access your account and get started on your tax preparation efficiently.

For Web Users

1. Navigate to the Website: Open your preferred web browser and go to myturbotax.intuit.com.

2. Enter Your Credentials: In the login page, input your user ID and password in the respective fields.

3. Secure Login: Click on the ‘Sign In’ button. If you have enabled two-factor authentication, you will need to verify your identity with an additional step.

4. Access Your Account: Once logged in, you will be directed to your dashboard where you can start or continue your tax filing.

For App Users

1. Download the App: If you haven’t already, download the TurboTax app from the App Store or Google Play Store.

2. Open the App: Launch the TurboTax app on your device.

3. Login: Enter your user ID and password. Tap on ‘Sign In’ to proceed.

4. Verify Your Identity: Follow the prompts for two-factor authentication if set up.

5. Start Using TurboTax: With successful login, you can immediately begin working on your taxes or review your filing status.

Tips for Creating a Strong Password and Securing Your Account

1. Use a Mixture of Characters: Include a combination of uppercase letters, lowercase letters, numbers, and special characters to enhance password strength.

2. Avoid Common Words: Do not use easily guessable passwords such as “password,” your name, or sequential numbers.

3. Length Matters: Aim for at least 12 characters in your password for better security.

4. Utilize Passphrases: Consider using a random phrase or a string of unrelated words, making your password easier to remember but hard to guess.

5. Change Regularly: Update your password periodically to bolster account security.

6. Enable Two-Factor Authentication (2FA): Always opt for 2FA to add an extra layer of security beyond just the password.

By following these steps and securing your login credentials, you can manage your taxes more safely and efficiently with TurboTax.

Troubleshooting TurboTax Login Issues

Experiencing trouble while trying to log into your TurboTax account can be frustrating. Here’s a straightforward guide to help you quickly resolve common login issues, ensuring you can access your account with minimal disruption.

What to Do if You Forget Your Username or Password

If you can’t remember your TurboTax username or password, don’t worry—recovery is just a few steps away:

- Reset Your Password: Visit the TurboTax login page and click on the “Forgot password” link. Enter your email address or username to receive a password reset link.

- Retrieve Your Username: If you’ve forgotten your username, click on “Forgot username?” on the login page. You’ll need to provide your email address or phone number associated with your account to receive your username details.

- Check Your Email: After submitting your request, check your email inbox for a message from TurboTax with further instructions. Be sure to check your spam or junk folder if you don’t see the email.

How to Handle Account Lockouts or Other Access Errors

Account lockouts can occur after several unsuccessful login attempts. Here’s how to regain access:

- Wait it Out: Typically, TurboTax accounts are locked for a short period to protect your security. Wait 15 minutes and then try logging in again.

- Clear Your Browser’s Cache: Sometimes, clearing your browser’s cache and cookies can resolve login issues. This refreshes your browser settings and removes old data that may be causing problems.

- Use a Different Browser: If problems persist, try accessing your account from a different web browser or a different device altogether.

Contacting TurboTax Support for Login Assistance

If the above steps do not resolve your login issues, it may be time to contact TurboTax support:

- Support Page: Visit the TurboTax support page where you can find various resources and FAQs that may address your issue.

- Live Chat: TurboTax offers a live chat feature for real-time assistance from a support representative.

- Phone Support: For more personalized support, you can reach out to TurboTax’s customer service via phone. Check their official site for the most current contact numbers and hours of operation.

By following these steps, you can swiftly address and resolve most TurboTax login issues, allowing you to return to managing your tax preparations efficiently.

Maximizing Your TurboTax Account

Understanding the features available after logging in can help you maximize your TurboTax account’s potential. Here are key features and some tips on utilizing these tools effectively:

Features Available After Logging In

- Auto-Import: Automatically import your W-2, 1099, and previous year’s tax return data from participating employers and financial institutions, reducing manual entry errors.

- Deduction Finder: Helps identify potential deductions tailored to your unique financial situation, ensuring you get the maximum refund possible.

- Real-Time Tax Refund Display: View your estimated refund amount in real time as you input your information. This feature keeps you motivated and informed throughout the filing process.

- Tax Categorization: TurboTax categorizes various income and expenses accurately, which simplifies the process of reporting for self-employed individuals and small business owners.

- Audit Risk Meter: Reduces the chance of an audit by checking your return for common triggers and providing tips on how to justify your deductions.

- Tax Return Review: Before filing, TurboTax offers a detailed review of your return to catch any potential issues or errors, ensuring accuracy.

Tips on How to Use TurboTax Tools for Optimal Tax Preparation

- Start Early: Begin your tax preparation early to take full advantage of the features TurboTax offers. Early preparation prevents last-minute rushes and gives you ample time to gather necessary documents.

- Utilize the Deduction Finder: Make sure to use the Deduction Finder to explore all possible deductions. This tool is especially useful for uncovering lesser-known deductions that can maximize your refund.

- Take Advantage of Auto-Import: Use the Auto-Import feature to save time and avoid discrepancies in your tax return by importing data directly from source documents.

- Review Audit Risk Meter: Regularly check the Audit Risk Meter to understand potential red flags. Take corrective actions as suggested by the tool to reduce your chances of an audit.

- Double-Check with Tax Return Review: Use the Tax Return Review feature to go over your return thoroughly before submission. This final check can be crucial in catching any overlooked errors or inconsistencies.

By leveraging these features and tips, you can ensure a smoother, more efficient tax preparation experience with TurboTax, leading to better accuracy and potentially a larger refund.

Maintaining Account Security

Keeping your TurboTax account secure is crucial to protect your personal and financial information. Below are the best practices and maintenance tips to ensure your login credentials remain safe and your account stays secure.

Best Practices for Securing Your TurboTax Account

- Use Strong, Unique Passwords: Always opt for passwords that combine letters, numbers, and symbols. Avoid common words or easily guessable sequences.

- Enable Two-Factor Authentication (2FA): Adding this extra layer of security ensures that accessing your account requires more than just your password, typically a code sent to your phone or email.

- Regularly Update Security Questions: Choose security questions that are not easily answerable with information someone could find on your social media or through a quick search.

- Monitor Account Activity: Regularly check your account for any unauthorized activity. TurboTax offers options to review login history and account changes.

- Secure Your Devices: Ensure that any device you use to access TurboTax is protected by anti-virus software and a firewall. Keep your operating system and applications updated to protect against vulnerabilities.

Regular Maintenance Tips for Your Login Credentials

- Change Passwords Regularly: Update your TurboTax password every few months to lessen the risk of unauthorized access.

- Avoid Using Shared Networks: When accessing your account, prefer a secure, private network over public Wi-Fi to prevent intercepts of your login information.

- Logout After Each Session: Always log out from your TurboTax account on all devices after you are done, especially on shared or public devices.

- Educate Yourself on Phishing Scams: Be aware of phishing attempts that trick you into providing your credentials. TurboTax will never ask for your password via email or over the phone.

By following these best practices and regularly maintaining your login credentials, you can greatly enhance the security of your TurboTax account, ensuring that your sensitive information remains protected.

FAQs about TurboTax Login

1. How do I log into my TurboTax account?

To log into your TurboTax account, visit the TurboTax website and click on the “Sign In” link at the top right corner of the homepage. Enter your username and password in the fields provided. If you are a new user, you will need to create an account by selecting “Create Account” and following the instructions.

2. What should I do if I forget my TurboTax password?

If you’ve forgotten your password, click the “Forgot Password” link on the sign-in page. You’ll be asked to enter your email address or user ID associated with your TurboTax account. Follow the prompts to reset your password via the email link sent to you.

3. Can I access my TurboTax account from my mobile device?

Yes, TurboTax offers a mobile app that allows you to access your account and continue your tax filing process from your smartphone or tablet. The app is available for download on both Android and iOS platforms.

4. Is my personal information safe when logging into TurboTax?

TurboTax employs industry-standard security measures to protect your personal information. This includes the use of encryption technology to secure your login credentials and financial data.

5. What should I do if I encounter issues logging into my account?

If you face any difficulties logging into your account, ensure that you are entering the correct login details. If the problem persists, try clearing your browser’s cache and cookies or use a different browser. You can also contact TurboTax support for further assistance.

Conclusion

In summary, having ready access to your TurboTax account is pivotal for streamlined tax management and financial planning. This platform not only simplifies the process of filing taxes but also provides crucial tools and insights to optimize your returns.

We strongly encourage utilizing TurboTax to ease the complexities of tax season, ensuring you can focus more on what matters most in your life and less on bureaucratic intricacies. Dive into the convenience of TurboTax today, and experience a smoother tax filing journey with confidence.

References

For additional information and to validate the details provided about TurboTax login, you may refer to the following reputable sources:

- Intuit TurboTax Official Website: Visit the official TurboTax website for comprehensive guides and the latest updates directly related to TurboTax services and login procedures.

- IRS Guidelines on Tax Software: The IRS official website provides critical insights and guidelines on using tax software effectively for filing returns, which can be useful for TurboTax users.

- Consumer Reports on Tax Software: For unbiased reviews and comparisons of tax software including TurboTax, check out Consumer Reports.

Each of these sources offers valuable content that can enhance your understanding of TurboTax and ensure you use the service most effectively.