IRS Login: Welcome to our guide on navigating the IRS online account system. The IRS, or Internal Revenue Service, is crucial for tax management in the U.S.

This article provides step-by-step instructions to help you securely log in to your IRS account, ensuring you can manage your tax obligations efficiently and effectively.

What You Need Before You Begin

Before you start the process of logging into your IRS account, ensuring you have all necessary items and security measures in place will streamline the experience and protect your sensitive information. Here’s what you need to gather and do before you begin:

Prerequisites for Creating or Accessing an IRS Account:

- Social Security Number (SSN) or Individual Tax Identification Number (ITIN): You will need your SSN or ITIN as it serves as a crucial identifier for your tax records.

- Email Address: Have a valid and accessible email address ready. This will be used for account verification and communication purposes.

- Tax Filing Status and Address: Know your most recent tax filing status and the address you used on your last tax return.

- Personal Account Number from a Credit Card, Mortgage, Home Equity Loan, Home Equity Line of Credit, or Car Loan: This information is used to verify your identity.

- Mobile Phone: If it’s linked to your name, it can be used for faster and more secure verification via text message.

- Identity Protection PIN (if you have one): This is especially necessary if the IRS has issued you an IP PIN for identity theft protection.

Security Measures to Have in Place:

- Secure Internet Connection: Always use a secure, private Wi-Fi network. Public Wi-Fi can expose your personal information to unauthorized users.

- Updated Anti-Virus/Anti-Malware Software: Ensure that your computer or device is protected against threats that could compromise your sensitive data.

- Strong Passwords: Create a strong, unique password for your IRS account. Consider using a password manager to keep track of it.

- Two-Factor Authentication (2FA): Enable 2FA on your IRS account for an additional layer of security, requiring not just a password and username but also something that only you, as the user, have on you.

- Familiarity with Phishing Scams: Be aware of common phishing tactics used by cybercriminals. The IRS will never initiate contact with taxpayers via email, text messages, or social media channels to request personal or financial information.

By preparing these prerequisites and ensuring robust security measures, you can safely create or access your IRS account with confidence, keeping your personal information secure throughout the process.

Logging Into Your IRS Account

Navigating the login process for your IRS account can be straightforward, whether you’re accessing it via web or through the app. Here’s a simple guide to help you log in and manage your account efficiently and securely.

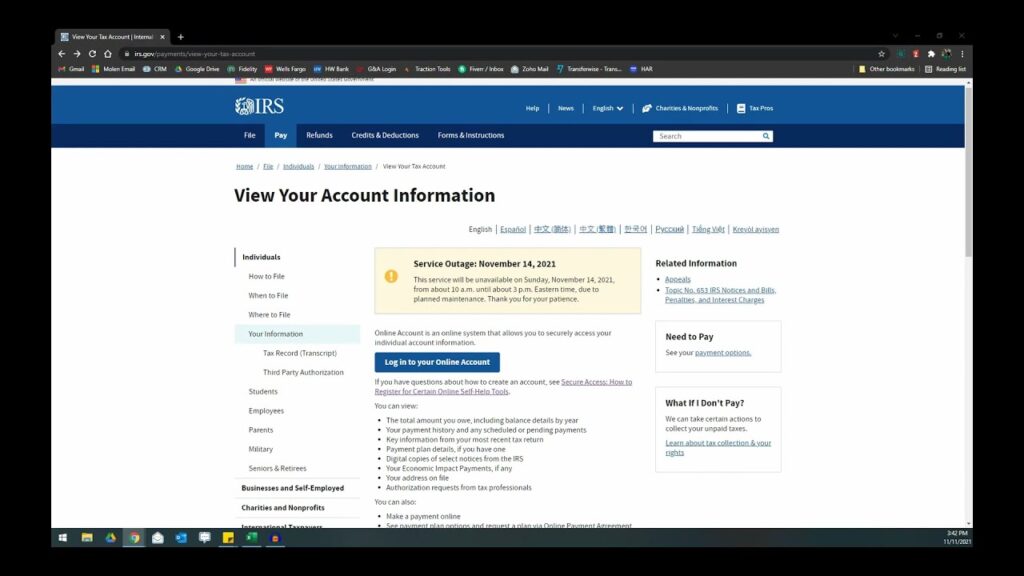

For Web Users

1. Visit the Official IRS Website: Go to IRS.gov and click on the ‘Sign In’ button located at the top right corner of the homepage.

2. Enter Your Credentials: Type in your username and password in the designated fields. If you’re a first-time user, you may need to register first by clicking on ‘Create Account.’

3. Multi-Factor Authentication: For added security, the IRS requires a two-factor authentication process. You’ll receive a code via SMS or email that you need to enter to complete your login.

For App Users

1. Download the IRS2Go App: Install the official IRS application, IRS2Go, from your smartphone’s app store.

2. Open the App and Navigate to Login: Tap on the ‘Login’ section to proceed.

3. Input Your User Information: Enter your username and password. Similar to the web login, you will need to complete a two-factor authentication process to access your account.

Tips on How to Manage and Securely Store Login Credentials

1. Use a Password Manager: Tools like LastPass or 1Password can help securely store and manage your passwords. They also help in generating strong, unique passwords for every account.

2. Enable Two-Factor Authentication (2FA): Always activate 2FA on your accounts. It adds an extra layer of security by requiring not only a password and username but also something that only the user has on them, i.e., a piece of information only they should know or have immediately to hand – such as a physical token.

3. Regularly Update Your Passwords: Change your passwords regularly to fend off potential security breaches. Avoid using common or previously used passwords.

3. Keep Your Security Software Updated: Ensure that your antivirus and anti-malware software are up to date to protect your devices from new threats.

By following these steps and tips, you can securely access and manage your IRS account both through the web and via the mobile app.

Navigating Your IRS Account Dashboard

Navigating the IRS Account Dashboard can simplify managing your tax obligations and accessing important tax information. This centralized platform provides a user-friendly interface, allowing you to swiftly and securely manage your tax details.

Key Features Accessible Through the IRS Account Dashboard

Upon logging into your IRS account, you will find several features designed to make tax management straightforward:

- Personal Information Update: Easily update your address, phone number, and filing status to ensure the IRS has your current details.

- Refund Status: Quickly check the status of your tax refund, including expected timeframes and any issues that might delay processing.

- Account Balances: View detailed account balances for different types of taxes, such as income tax or estimated taxes, including payment history and current amounts owed.

- Payment Options: Access various payment options to settle your tax dues, including direct pay, installment agreements, or payment via credit or debit cards.

How to Update Personal Information

To update your personal information:

- Log in to your IRS account.

- Navigate to the “Profile” section.

- Select “Edit” to update your personal details.

- Save the changes to ensure your new information is recorded.

Checking Refund Status and Viewing Account Balances

Checking your refund status and viewing account balances is straightforward:

- From the dashboard, select “Refund Status” to see detailed information about your tax refund.

- For account balances, click on the “View Balances” section to see detailed records of what you owe or have paid.

Downloading or Requesting Official Documents

Downloading or requesting official documents such as tax transcripts can be done in a few steps:

- From the dashboard, navigate to the “Documents” section.

- Choose the type of document you need, such as a tax transcript.

- Select “Download” to get a digital copy or “Request Mail” to receive a physical copy via post.

By familiarizing yourself with these features, you can take full control of your tax matters directly from the IRS Account Dashboard, ensuring that managing your taxes is as seamless and efficient as possible.

Troubleshooting Common IRS Login Problems

Experiencing trouble while trying to log in to your IRS account can be frustrating. Many users face issues such as account locks, error messages, or disruptions due to site maintenance. Here, we’ll provide practical solutions to these common problems and offer contact information for IRS support.

Account Locks

If your account gets locked, it usually means there have been multiple unsuccessful login attempts. To resolve this:

- Wait 15 minutes before trying to log in again. This brief period allows the lock to reset automatically.

- Ensure you are using the correct login credentials. If unsure, you can reset your password by clicking on the “Forgot Password” link and following the prompts.

Error Messages

Error messages can vary, but they generally indicate a problem with the information entered or an issue on the website. To troubleshoot:

- Double-check the information you entered for any mistakes.

- Clear your browser cache and cookies, and try logging in again.

- If the problem persists, try accessing the site with a different browser or device to rule out browser-specific issues.

Site Maintenance

The IRS regularly updates its website, which can lead to temporary unavailability. If you suspect this might be the case:

- Check the IRS homepage for any maintenance announcements.

- Schedule your login attempts outside of the typical maintenance windows (often noted on the site).

- If the site is down unexpectedly, the IRS usually provides an ETA for when it will be back online.

For further assistance, you can contact IRS support directly. Visit the IRS website’s “Help” section or call their support line at 1-800-829-1040 for guidance on login issues. They are available from 7 AM to 7 PM local time, Monday through Friday.

By following these steps, you can often resolve common login issues quickly and regain access to your IRS account.

Enhancing the Security of Your IRS Account

Securing your IRS account is crucial to protect your personal information and prevent identity theft. Here are some effective tips to enhance the security of your IRS account:

Create Strong Passwords

- Use a Combination of Characters: Your password should be at least 12 characters long and include a mix of uppercase letters, lowercase letters, numbers, and symbols.

- Avoid Common Words: Stay clear of easily guessable passwords such as “password123” or your name. Instead, opt for a random combination of words and characters.

- Use a Password Manager: To keep track of your complex passwords, consider using a reliable password manager.

Set Up Multi-Factor Authentication (MFA)

- Activate MFA: Always enable multi-factor authentication on your IRS account. This adds an extra layer of security by requiring a second form of verification.

- Choose a Secure Method: Use authentication apps or physical security keys when possible, as they are more secure than SMS-based verification.

Regularly Update Security Settings

- Check Settings Periodically: Regularly review and update your security settings to ensure they meet the latest security standards.

- Change Passwords Regularly: Although it’s crucial to create a strong password, changing it regularly can help safeguard your account against ongoing security threats.

Monitor Account Activity

- Set Up Alerts: Enable alerts for any unauthorized access or suspicious activities. This will ensure you are promptly informed of any irregular actions.

- Review Account Logs: Frequently check your account logs to spot any unauthorized transactions or changes to your account details.

By following these steps, you can significantly enhance the security of your IRS account, ensuring your sensitive information remains protected against potential cyber threats.

FAQs about IRS Login

1. How do I create an IRS account?

To create an IRS account, visit the official IRS website and click on the “Create Account” button. You’ll need to provide your email address, social security number, and some personal information to verify your identity. Follow the on-screen instructions to complete the registration.

2. What should I do if I forget my IRS login password?

If you forget your password, click the “Forgot Password” link on the IRS login page. You will need to enter your username and follow the prompts to reset your password. Make sure you have access to the email associated with your IRS account as a verification code will be sent there.

3. Can I access my IRS login on a mobile device?

Yes, you can access your IRS account from a mobile device. The IRS website is mobile-friendly, and there are also official IRS mobile apps available for download, which provide secure access to your account information.

4. Is it safe to use my IRS login on public computers?

It is not recommended to access your IRS account on public computers due to security risks. If you must, ensure that you log out completely after your session and clear the browser cache.

5. How can I update my personal information in my IRS account?

To update your personal information, log into your IRS account and navigate to the profile settings. From there, you can update your address, phone number, email, and other personal details. Ensure your information is always current to receive timely updates from the IRS.

Conclusion

In summary, accessing and managing your tax information through the IRS login portal is streamlined and user-friendly. Whether you’re filing taxes, checking your refund status, or managing payment plans, the online system is designed to help you navigate your tax responsibilities efficiently.

However, it is crucial to prioritize the security of your personal information. Always ensure that you are accessing the IRS website directly through a secure and private connection. Avoid sharing your login credentials and promptly log out after each session to protect your sensitive information.

By taking these precautions, you can safely utilize the benefits of the IRS’s online services, keeping your tax records secure and your peace of mind intact.

References

For further reading and to validate the information provided about the IRS Login process, the following reputable sources are invaluable:

- IRS Official Website – Access comprehensive information directly from the Internal Revenue Service for detailed guidance on navigating and utilizing the IRS login portal. Visit IRS.gov.

- Taxpayer Advocate Service – This independent organization within the IRS offers a wealth of resources aimed at helping taxpayers resolve specific issues with the IRS, including login problems. Explore more at Taxpayer Advocate.

- USA.gov – As a centralized platform for government resources, USA.gov provides essential links and step-by-step processes related to tax obligations and the IRS login procedure. Find out more by clicking USA.gov.

These sources ensure that the content is accurate and trustworthy, helping users confidently manage their IRS accounts.